Christ-centered Giving

Each year the support we receive from families along with civic and business philanthropist allows us to fulfill our Christ-centered mission.

3 Ways to Give Annual Giving Program Apogee Tax Credits Community Giving .

#1The Lion Fund: Annual Giving Program

The Lion Fund is our primary fundraiser. The Fund is key to the school's financial stability.

Still Waters International Academy’s mission is accomplished each year from the blessings and generosity of our families, the support of the Church, the community and people like you. The Lion Fund is our annual campaign and our primary philanthropic activity. Each and every contribution allows to maintain a Christ-centerred focused and supported our students and teachers in way that are inspired by The Lord. Consider joining us in the mission today.

| Contribution Levels | ||

|---|---|---|

| Lion Platinum Founder | $10,000+ | |

| Liddell Members | $9,999-$7,500 | |

| Benefactors Circle | $7,499-$5,000 | |

| Scholars Circle | $4,900-$3,500 | |

| Leaders Circle | $3,499-$1,500 | |

| Partners Circle | Up to $1,499 | |

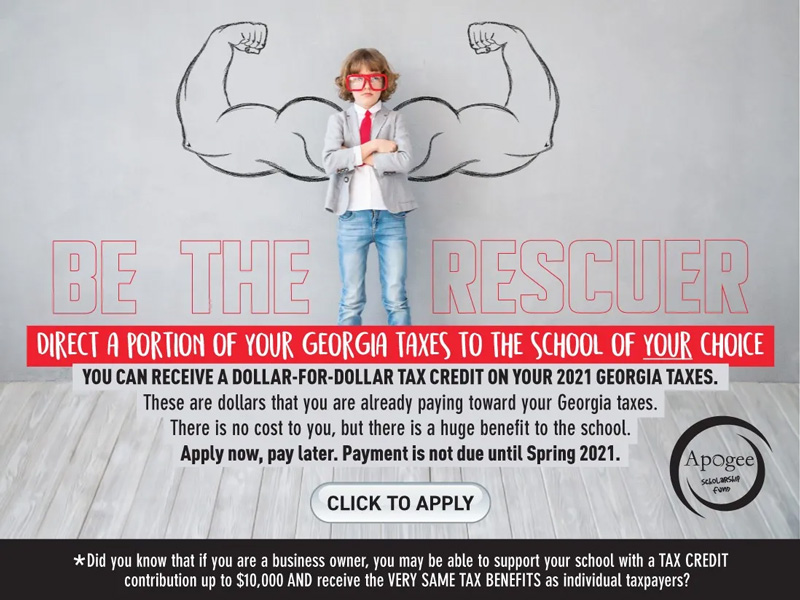

#2The Apogee Scholarship: Tax Credit Scholarhip Program

Still Waters participates in the Apogee Scholarship Fund, which takes advantage of the Georgia Tax Credit Program: a K-12 scholarship opportunity allowing individuals, families and businesses in the state of Georgia to direct a portion of their state taxes to the private school of their choice. Program contributions provide direct scholarship funds to children whose families would otherwise not afford a private education.

The Apogee Tax Credit FAQs

Apogee Scholarship Fund is a state registered SSO (Student Scholarship Organization) as well as a 501c3 non-profit organization whose primary functions are to facilitate the process of distributing tax credits in exchange for donations and to disburse those funds for private school tuition scholarships.

Apogee (ap-uh-jee) is defined as the highest point (typically of an arc). To this end, Apogee strives to help children reach their highest educational potential.

Under this law, you can redirect a portion of your Georgia income tax to provide financial aid assistance to SWIA students based upon need. You will receive a tax credit on your state income taxes and a charitable deduction on your federal incomes taxes for the amount of your contribution.

It’s easy. All you have to do is complete our easy paperless process, and Apogee will submit the paperwork on your behalf. Apogee will process your approval notice within 30 days. Once the approval notice is received, please send your payment by check or pay online within 60 days of your approval date.

Yes, the amount you can give is limited by your tax filing status:

- Married Filing Jointly: Maximum of $2,500

- Individual Filer: Maximum of $1,000

- Married Filing Separately: Maximum of $1,250

- Individuals who receive pass-through income can contribute up to $10K

- C-Corporation: Up to 75% of GA tax liability

Although we understand why it would be ideal to designate specific recipients, this is not possible. Apogee does not accept donations that are allocated for specific individuals. Donors would lose their ability to receive a charitable contribution, as well as the Georgia tax credit.

Apogee is a 501c3 non-profit organization and, as such, is bound first and foremost by the rules and regulations governing this special status. As a 501c3, Apogee is not permitted to accept any donations directed to a specific individual. To do so would put Apogee’s non-profit status in jeopardy and, in turn, its SSO status in jeopardy.

Your Georgia tax liability is typically 6% of your Adjusted Gross Income (AGI). You can also look at Line 16 of your GA tax return (Form 500) to learn your GA tax liability.

The State has placed a yearly cap on the amount of credit available. That amount is $100 million. That means that every school, every taxpayer, and every corporation in Georgia is drawing from the exact same pool of credits.

Once the funds are distributed, interested agencies must wait until the following year to participate in the program. Once funds are deposited, they are immediately available to assist families who want the best educational choice for their children.

Please note: The yearly cap is generally met on the very first day of January. For this reason, it is strongly encouraged to submit your application as soon as possible to be considered for approval.

This is a great opportunity to write the check to support education instead of paying that portion of estimated taxes. Please ask your accountant to reduce your quarterly estimated tax payment by the amount of your contribution. This will reduce each of your quarterly payments by 25% of the amount you intend to contribute

The tax credit is a “non-refundable” credit. This means you cannot receive a refund for any more than your GA tax liability. Any excess credit beyond your tax liability can be carried forward for up to five years.

No. Apogee cannot accept payments prior to January 1. Since the vast majority of applications received are early applications, payment should be made after approval has been secured. Payment must be made within 60 days of approval.

Yes. Apogee is well versed in the specifics of how this credit affects most tax scenarios and is happy to offer guidance regarding how this credit is related to your specific tax situation. For more information, contact our Apogee representative, John Panessa:

jpanessa@apogee360.com

or (404) 419-7123

#3Community Giving Programs

By registering for a community giving program you have an opportunity to show your support for Still Waters simply by going about your daily business.

Choose from the available programs below and make an impact without disrupting your normal routine. Our students and staff thank you!

PUBLIX PARTNERS PROGRAM

Show your support when you go shopping this week! When you sign up for the Publix Partners Program, a portion of the sale will be donated to your school of choice. Log In at Publix.com and from the My Account screen choose Still Waters International Academy as your Publix Partner. Click here to sign up for a Publix.com account if you do not have one already.

The next time you go shopping, enter your phone number at checkout and Publix will give back to Still Waters on each eligible item purchase you make.

Click here to view our Publix Partner Page and track our progress. The Program is available in many participating states where Publix is found so help spread the word to friends and family!

GENERAL MILL BOX TOPS

The General Mills Box Tops for Education program has made it easier to donate than ever before! Instead of clipping and collecting box tops, use the Box Tops App from your smartphone to scan your grocery receipt and Still Waters will receive 10 cents for every eligible product. You must scan receipts within 14 days after purchase in order for products to count towards a donation.

- Join Free at BTFE.com and search for Still Waters Learning Center

- Download the Box Tops App for your Android or Apple smartphone

- Scan your receipt to detect eligible purchases

- Log In and Track our progress

AMAZON SMILE PROGRAM

The Amazon Smile program is an easy way to make a donation while doing your normal online shopping. When you check out through smile.amazon.com, or link AmazonSmile to your Amazon Shopping app, Amazon will donate 0.5% of the transaction on every eligible item to the Still Waters.

- Go to: smile.amazon.com and sign in with your Amazon account.

- Choose Still Waters Learning Center as your charity organization.

- From your smartphone, download the Amazon App for Android or iPhone

- Open your app settings from the main menu and tap ‘AmazonSmile’ to link the app to your charity organization

- If you prefer shopping through a web browser, just remember to always complete your checkout from smile.amazon.com for your donation to count.

KROGER COMMUNITY REWARDS PROGRAM

Let’s “Go Krogering” this week and make a difference by participating in the Kroger Community Rewards Program! Just Sign into your Kroger Account at www.kroger.com, open the My Account window and choose Community Rewards from the menu.

Search by Organization Name: Still Waters International Academy

Or Organization Number: XY027

Enter your associated Kroger Plus phone number as usual during checkout and a portion of your eligible purchases will be donated toward the school! Thank you for your support!